Another shot at resolving direct tax disputes

After several measures to reduce legal wrangles, the government plans a new Bill to simplify taxation

The government has taken various steps to settle direct tax disputes, but legal rows between the authorities and taxpayers refuse to end. In fact, disputes are increasing if the money involved is any indication.

The previous United Progressive Alliance government tried to bridge the gap between the authorities and taxpayers by simplifying the language in the Direct Taxes Code (DTC) Bill, 2010 (it was to replace the Income Tax Act, 1961) and raising monetary limits to file appeals before the Income Tax Appellate Tribunal (ITAT), High Courts and the Supreme Court.

The DTC Bill lapsed with the dissolution of the 15 Lok Sabha. Arun Jaitley, as Finance Minister in the first government of Prime Minister Narendra Modi, junked the idea of a fresh DTC Bill in his Budget speech for 2015-16.

The Bill aimed to rationalise income tax slabs by having fewer exemptions and reducing tax rates. The second Modi government’s new tax regime is carrying out that work but it still has too many tax slabs – six (excluding zero per cent). For corporation tax, the government overhauled rates in 2019 and made them available to companies opting for lower exemptions.

Fewer exemptions reduce the scope for interpretations and disputes.

The Modi government has taken several other steps to reduce disputes. As Finance Minister Nirmala Sitharaman said in her Budget speech last week: "Over the past 10 years, our government has implemented several reforms for convenience of taxpayers, such as (1) faceless assessment, (2) taxpayers charter, (3) faster returns, (4) almost 99 per cent returns being on self-assessment, and (5) Vivad se Vishwas scheme."

The government announced the Direct Tax Vivad se Vishwas scheme (VVS) 1.0 in 2020. According to a written reply in Parliament, 1,31,714 people applied for settlement under the scheme of which 1,13,894 disputes to the tune of Rs 75,788.25 were settled.

As many as 33,000 tax payers availed of VVS 2.0 scheme, the deadline of which ended in January, Sitharaman said.

The government has raised monetary limits for filing appeals challenging the orders of lower authorities in income tax disputes. Such limits were raised 15 times for filing appeals before ITAT and 20 times each before High Courts and the Supreme Court in 10 years of the Modi government (chart 1, click image for interactive link).

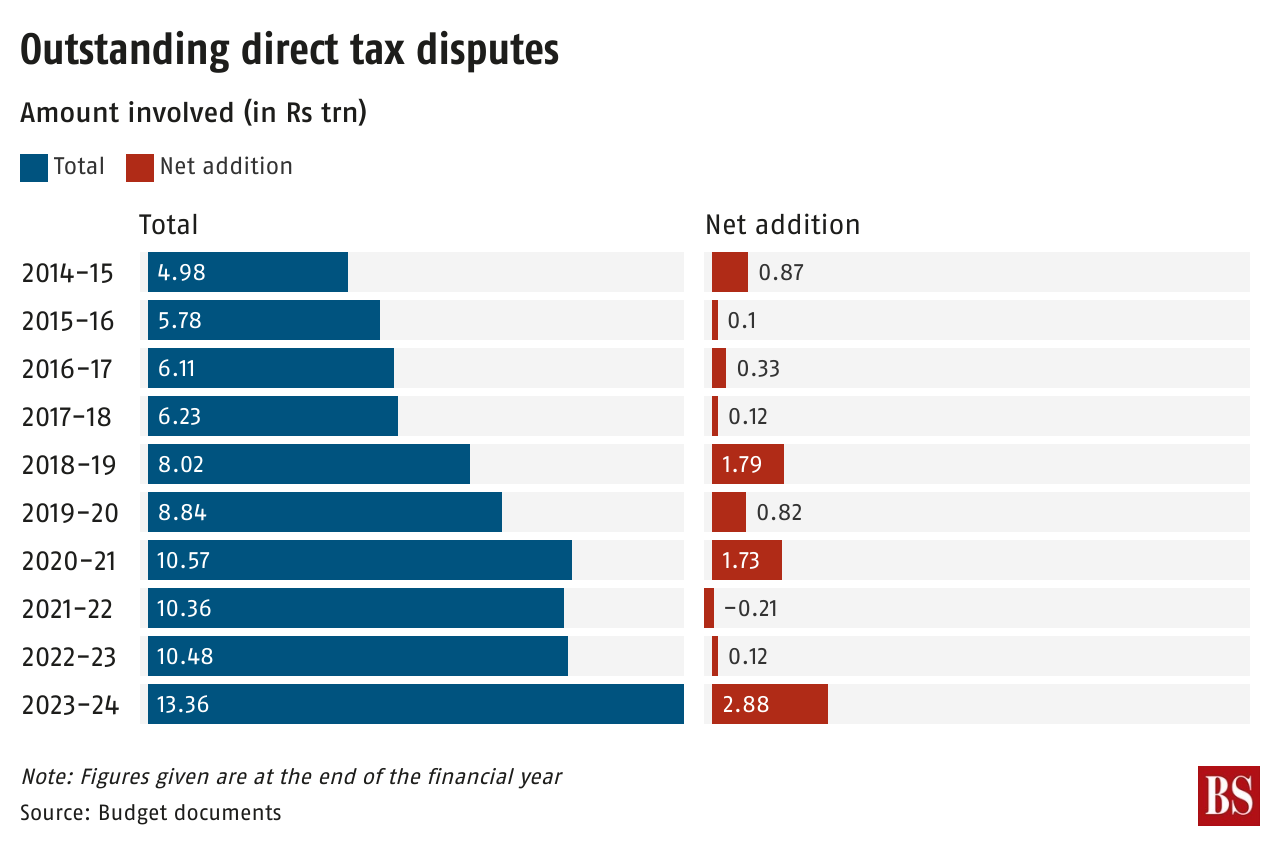

Despite these steps, the sum involved in outstanding direct tax disputes has been rising, barring 2021-22. It means more tax payments (value wise) were disputed year after year than resolved. In fact, the net addition to the sum disputed was highest in 2023-24 (chart 2).

Barring 2014-15, 2019-20 and 2021-22, most years saw a higher amount of outstanding tax disputes in corporation tax than personal income tax. In 2023-24, the sum involved in corporation tax disputes was 52 per cent higher than that in personal tax rows (chart 3).

It may be the reason behind the government’s plan to bring a Bill in Parliament to amend the Income Tax Act to simplify the language and procedures to reduce direct tax disputes.