Asset reconstruction companies need to rebuild

They have been losing business as the IBC process picks up pace

In 1803, a group of English tailors shared information about customers not settling their debts. The Manchester Guardian Society, which published data on defaulters, was established in 1826. Reporting mechanisms have improved, but countries are yet to fully fix debt recovery.

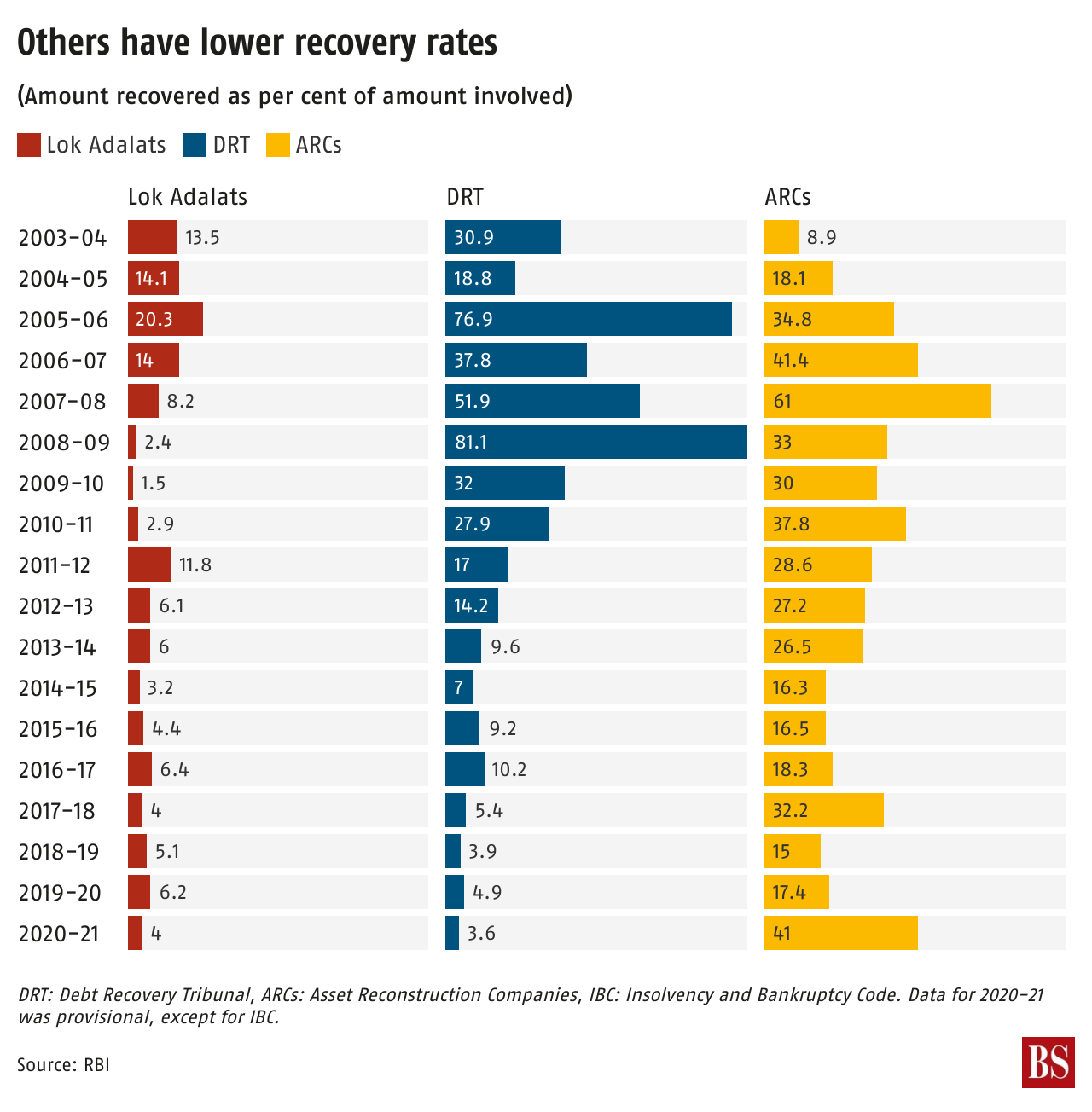

India tried to fix the problem with debt recovery tribunals, then asset reconstruction companies (ARCs), and later instituted the Insolvency and Bankruptcy Code in 2016. Though IBC has not performed as well as expected, a ‘Business Standard’ analysis shows that its recovery rates are higher than other debt settlement modes.

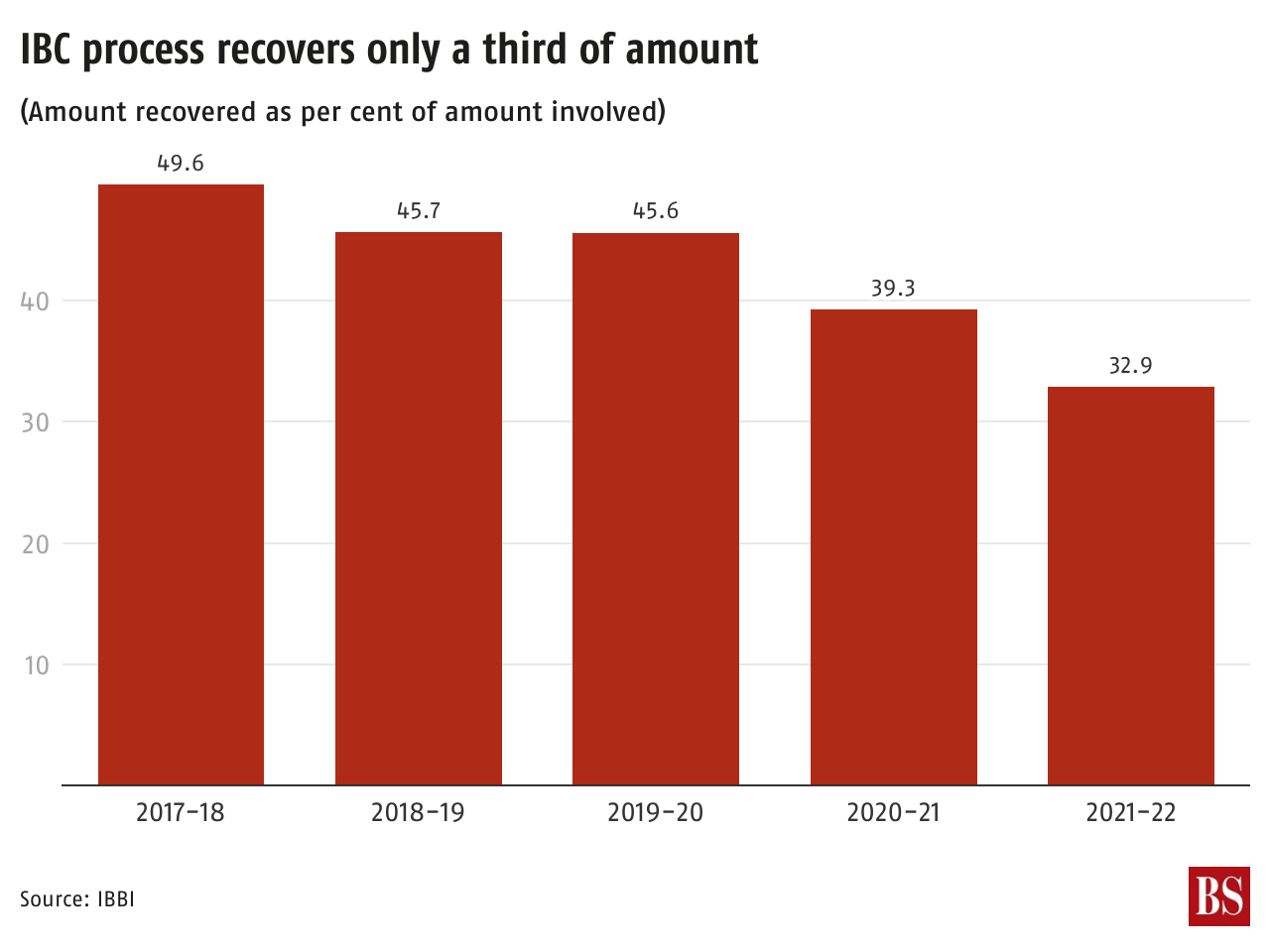

Companies recovered a third of the amount involved under the IBC in 2021-22.

For the four years until 2020-21, the recovery from IBC averaged 43.5 per cent, compared to 26.4 per cent for ARCs, 4.5 per cent for debt recovery tribunals and 4.8 per cent for Lok Adalats.

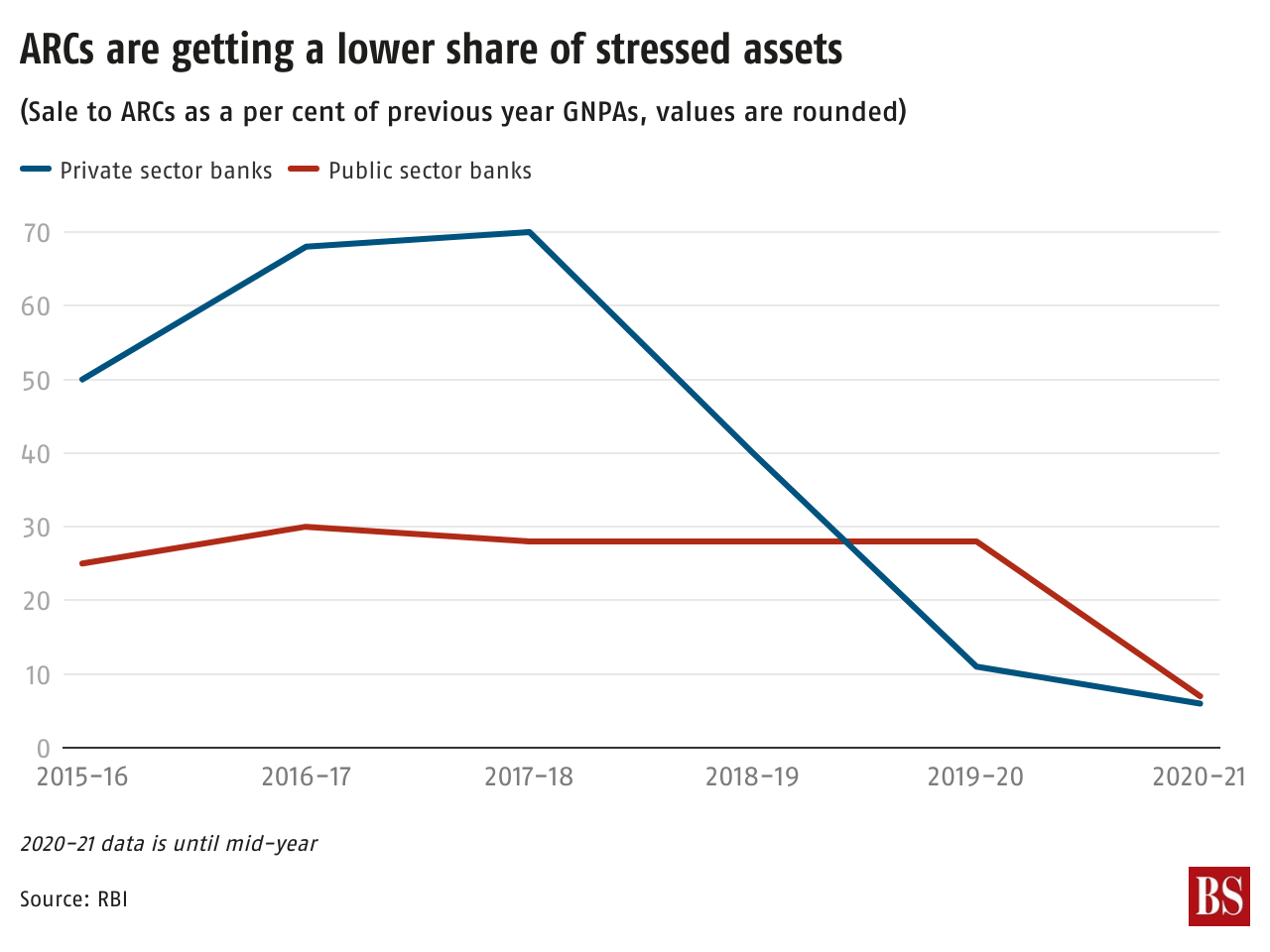

Allocation of gross non-performing assets (GNPAs) to the IBC process has increased during this period. ARCs, which buy bad loans from banks and financial institutions, have lost out. ARCs had a recovery rate of 42.6 per cent at their peak between 2005-06 and 2008-09 but has declined since.

Private sector banks, which once regarded ARCs as a viable solution for asset recovery, have abandoned them as acquisition costs over book value worsened, reflecting lower realisations. The sale of bad assets by private sector banks to ARCs declined from a high of more than 70 per cent in 2015-16 to less than 10 per cent in 2020-21.

India needs all its debt recovery systems to work: The IBC system is doing better but is overburdened.

By March 2022, the IBC recovery rate had declined compared to previous years. The time taken for resolution had increased to 700 days, as against the envisaged time of 330 days.