In India’s hotels, why you can’t check in any time you like

Domestic tourism is booming, helping hospitality groups to beat pandemic downturn

Empty rooms in a key hotel threatened to bring down the Oberoi Group in its pre-independence years, before the Second World War triggered a boom. The cash that came in (stuffed into mattress covers) helped build the formidable hospitality empire.

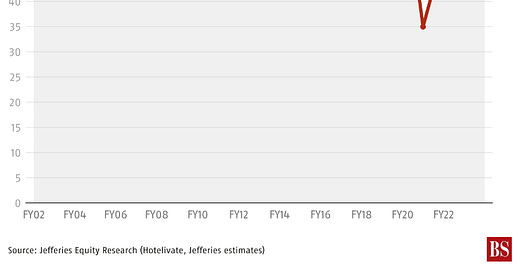

Hotel occupancy across India is rising after years of lacklustre growth. The group of 20 (G20) meeting in Delhi saw hotels fully booked early September. Something similar also played out in Ahmedabad, after the 2023 Cricket World Cup schedule was announced. The hotel business has turned around after occupancy dropped to 35 per cent in Financial Year 2020-21 (FY21) because of the pandemic. The average in the five years leading to the pandemic was 64 per cent. There has been a steady recovery since and occupancy this year is expected to now reach levels last seen before the global financial crisis in 2008, as seen in chart 1 (click image for interactive link).

Indians are filling up hotel rooms. There were 8.4 million foreign tourist arrivals in India in the 12 months ending June 2023. That is 21 per cent lower than the 10.7 million seen over a comparable period ending June 2019. Domestic tourism remains robust. There were over 200 domestic tourists for every foreign traveller in 2022, compared to 74 in 2019 (chart 2).

The domestic tourism boom has led to a crunch at hotels. There are 2.2 hotel rooms per 1,000 people globally. It is 0.1 in India. China’s number is over three, while it is even higher in the US (chart 3).

Adding new hotel capacity can take between 3-5 years, according to a September 13 Equity Research report by financial services firm Jefferies; authored by analyst Prateek Kumar. It noted that land to set up new hotels in prime areas is scarce, as inflation in building material costs and labour expenses continue. According to the report, even with all factors taken care of, the average time taken to construct a new property can vary between 3-5 years.

The crunch means established hotels make money hand over fist, and you may well face longer queues at check-in.