Women have made some gains in financial participation, according to two reports released ahead of International Women’s Day on March 8. They show increased exposure to investments in mutual funds and borrowings from banks, but future progress may be affected by regional imbalances.

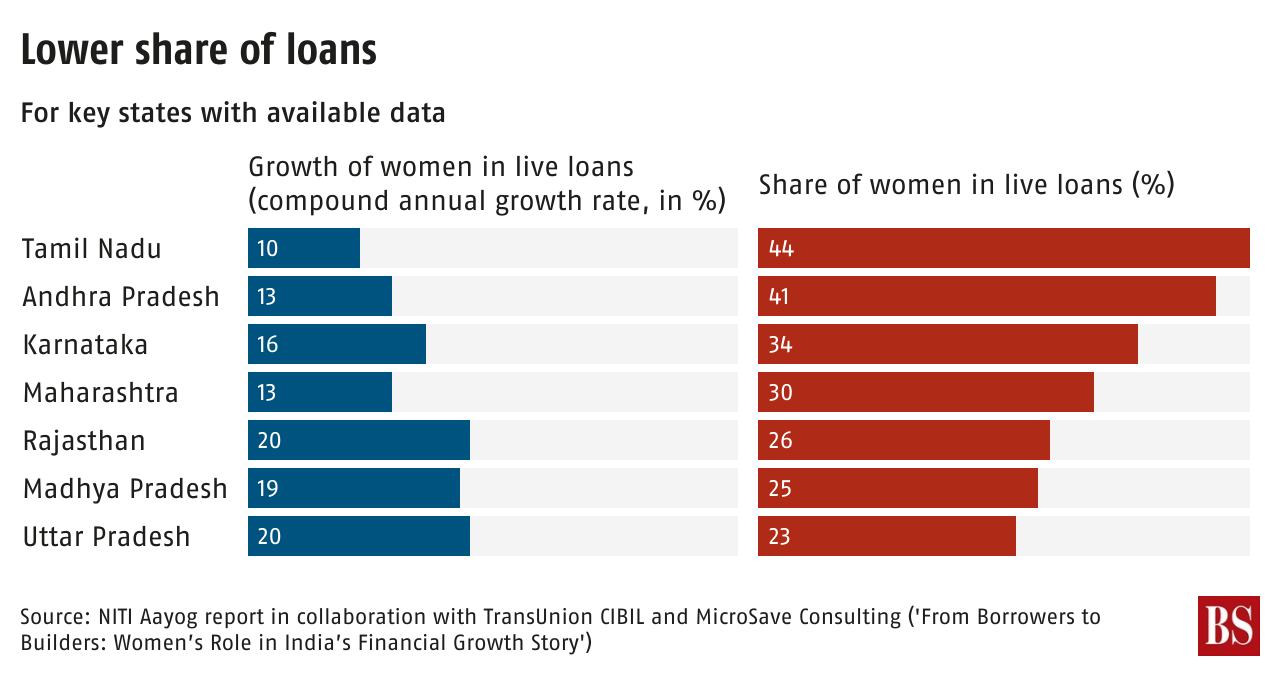

The size of the average female investment account has grown at 23 per cent compared to 5 per cent for men over five years, according to the Association of Mutual Funds in India (AMFI) report with Crisil Intelligence ‘The Sahi Journey AMFI-Crisil Factbook 2025’. The number of women looking to borrow capital tripled between 2019 and 2024, according to a NITI Aayog report in collaboration with TransUnion CIBIL and MicroSave Consulting. But AMFI’s data also shows that the share of women has remained stagnant at around 33 per cent of individual investors' mutual fund assets since 2019. Granular data from the NITI Aayog report, 'From Borrowers to Builders: Women’s Role in India’s Financial Growth Story', also shows that some regions are doing less well than others. Additional stock exchange data bears out the trend.

The share of women among registered investors has risen to 24.2 per cent in Financial Year 2024-25 (FY25), according to a Business Standard analysis of National Stock Exchange data as of January. But some regions lag behind. North India is at 20.5 per cent share compared to 25.9 per cent for the South and 26.1 per cent for the East (chart 1, click image for interactive link).

Large North Indian states trail, including Uttar Pradesh (18.5 per cent) and Bihar (15.7 per cent). In contrast, South Indian states like Karnataka and Kerala are over 27 per cent. It is over 29 per cent in Northeastern states of Mizoram, Assam and Sikkim.

This divide extends to banking as well. For example, the share of women in live loans is 44 per cent in Tamil Nadu compared to 23 per cent in Uttar Pradesh (chart 2).

Given the relative rates of population growth, the share of women living in areas underperforming in financial inclusion will only increase over the next decade or so. Northern India will account for twice as much of the country’s women as any other region in 2036 (chart 3).

It is not just the money invested but the money earned which may set the tone for financial empowerment. The share of women who had regular wage or salaried jobs hit a seven-year low of 15.9 per cent in 2023-24. Bihar and Uttar Pradesh were less than seven per cent in this metric.