Zombie companies haunt India Inc

Rising interest rates are a risk to firms whose earnings are not enough to repay debt

If Indian companies were people, around 20 per cent of the listed space would be individuals whose salaries don’t cover their loan instalments.

An analysis of 1,995 listed companies shows that 19.2 per cent of them earn less what is needed to meet interest payments. The interest coverage ratio is the ratio of a company’s earnings before interest and taxes (EBIT) to its interest payout. The ratio is less than one for 384 companies. They are called zombie companies if the ratio remains below one for three years in a row.

Howard Marks, the legendary American investor, recently said vulnerable companies could end up defaulting on their loans as global interest rates rise. Rates have mostly headed down for the last 40 years after touching 20 per cent in the United States (US) in 1980, he said in a recent note. He suggested that companies and investors used to benign environments may find the going tough when interest rates start to rise and loans are refinanced at higher costs. Rating agencies have pointed to increased chances of default in the US and Europe.

The share of Indian companies whose earnings are less than interest payments has been around 20 per cent for years now as seen in chart 1 (click image for interactive link).

The smallest companies also seem most at risk because of higher interest rates. The analysis ranked companies by net sales. A single-digit proportion of firms with net sales of Rs 1,000 crore or more had trouble meeting interest obligations from earnings. It was as high as 23.9 per cent for the smallest companies (chart 2).

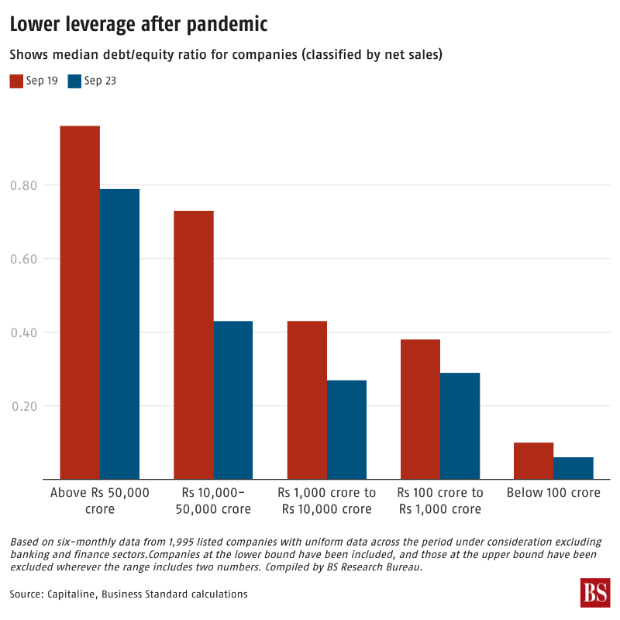

Indian companies do seem alive to the dangers of higher leverage. Companies irrespective of size have broadly brought down their debt/equity ratio, a measure of indebtedness. It has fallen from 0.96 to 0.79 for the largest firms, and similarly for others (chart 3).

The cost of capital shows a rising trend over the last year.

Banks’ weighted average lending rate has risen from 8.86 per cent in November 2022 to 9.34 per cent in November 2023.